Introduction:

Credit unions have a special place in the constantly changing financial services industry, where cyber threats and data breaches are major concerns. They provide individualized financial solutions and cultivate a strong sense of community within the local community. But because of their proximity to one another and the sensitive information they possess, members are easy targets for hackers.

Why Cyber Security Matters for Credit Unions

- Financial ruin: Data breaches, ransomware attacks, and other cyber events have the potential to completely stop operations, prevent members from accessing their money, and result in large recovery expenses.

- Erosion of trust: Member turnover and reputational harm may result from a breach of member data, which could destroy the trust that has been cultivated over many years.

- Regulatory compliance: The National Credit Union Administration (NCUA) mandates stringent cybersecurity regulations (CORE/CORE+) for credit unions, with hefty fines for non-compliance.

Building a Robust Cybersecurity Posture: Key Strategies

Embrace NCUA Regulations: A Foundation for Success:

- Create thorough rules and processes that comply with CORE/CORE+ specifications.

- Create a special internal team called CORE/CORE+ to support cybersecurity efforts and guarantee continuous compliance.

- Attend NCUA seminars and workshops, participate in the credit union cybersecurity community, and keep up with current requirements to be informed.

Cultivate a Culture of Cyber Awareness:

- Invest in staff training: To establish a culture of alertness and safe procedures, regularly hold awareness campaigns, security training courses, and phishing simulations.

- Give staff members the authority to report questionable activities right away, and promote honest discussion about cyber-related issues.

Fortify Your Defenses: Essential Tools and Technologies:

- Put multi-factor authentication (MFA) into place for all important access points and systems.

- Install intrusion detection/prevention systems (IDS/IPS) and strong firewalls.

- Keep your systems and software up to date to quickly repair vulnerabilities.

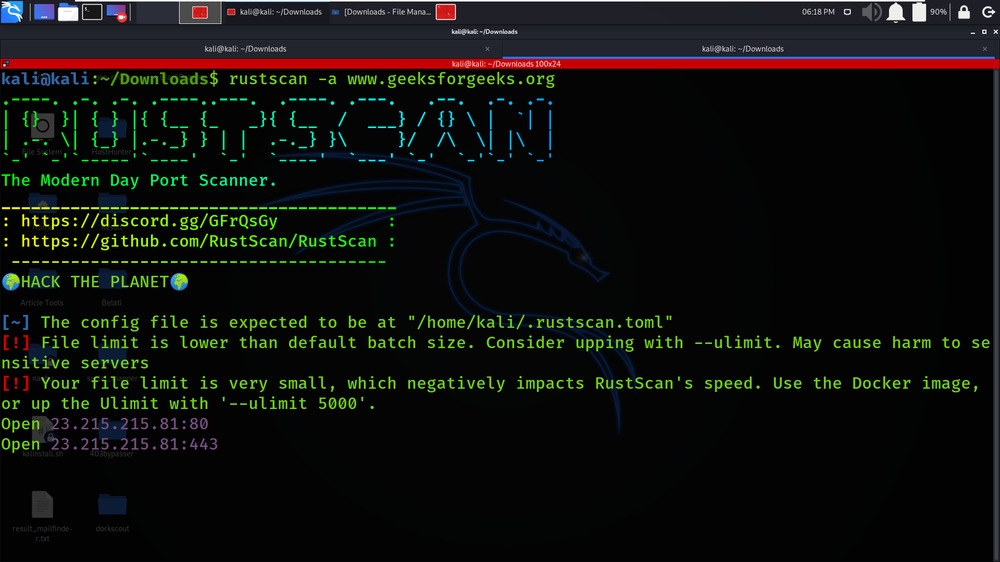

- To find and fix flaws, do regular vulnerability assessments and penetration tests.

- Create a thorough incident response strategy to direct a successful reaction and recovery in the event of a cyberattack.

Partnership is Key: Leveraging External Expertise

- For ongoing monitoring, vulnerability assessments, and penetration testing, work with reputable security companies.

- Seek advice from cybersecurity professionals to create unique plans and deal with certain issues.

Conclusion:

By proactively addressing cybersecurity threats, credit unions can safeguard their members’ data, ensure operational continuity, and maintain the trust that underpins their existence. By embracing NCUA regulations, cultivating a culture of awareness, implementing robust defenses, and leveraging external expertise, credit unions can build a resilient cybersecurity posture and navigate the ever-evolving threat landscape with confidence.